The cryptocurrency landscape in the United States presents a complex patchwork of regulations that vary significantly from state to state. If you're wondering, "Is crypto exchange legal in my state?" you're asking a critical question that deserves a thorough answer. This comprehensive guide will help you navigate the legal status of cryptocurrency exchanges across different states and understand what this means for you as an investor or trader.

Understanding the Regulatory Framework for Cryptocurrency

Before diving into state-specific regulations, it's important to understand the multi-layered approach to cryptocurrency regulation in the United States:

Federal Oversight

At the federal level, several agencies have established jurisdiction over different aspects of cryptocurrency activity:

- Securities and Exchange Commission (SEC): Oversees cryptocurrencies that qualify as securities

- Commodity Futures Trading Commission (CFTC): Regulates cryptocurrency derivatives and futures

- Financial Crimes Enforcement Network (FinCEN): Enforces anti-money laundering (AML) and Know Your Customer (KYC) requirements

- Internal Revenue Service (IRS): Handles taxation of cryptocurrency assets

- Office of Foreign Assets Control (OFAC): Enforces sanctions that may affect certain cryptocurrency transactions

While federal agencies provide overarching guidance, individual states have considerable autonomy in how they regulate cryptocurrency exchanges operating within their borders.

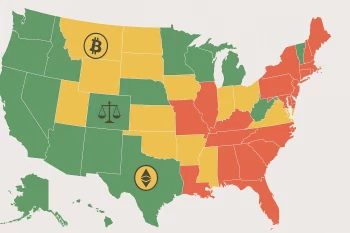

State-by-State Cryptocurrency Exchange Regulations

States generally fall into three categories regarding cryptocurrency regulation: crypto-friendly, neutral with specific regulations, and restrictive. Let's examine the current landscape across the United States.

Crypto-Friendly States

These states have enacted legislation specifically designed to encourage cryptocurrency business development:

1. Wyoming

Wyoming stands as the most progressive state for cryptocurrency regulation, having passed over 20 blockchain-friendly laws since 2018. The state:

- Created a special purpose depository institution (SPDI) charter for crypto banks

- Exempted utility tokens from securities laws

- Recognized direct property rights for digital asset holders

2. Texas

Texas has emerged as a major hub for cryptocurrency mining and exchange operations:

- The Texas Department of Banking issued guidance clarifying that state-chartered banks may provide custody services for cryptocurrencies

- No specific money transmitter license requirements for crypto-to-crypto exchanges

- Home to a growing number of cryptocurrency mining operations due to favorable energy prices and regulatory environment

3. Colorado

Colorado has positioned itself as a blockchain innovation center:

- Exempted cryptocurrency intermediaries from state securities laws in certain circumstances

- Passed the Colorado Digital Token Act to provide some regulatory relief for cryptocurrencies

- Created a blockchain advisory council to guide future legislation

4. Nevada

Nevada has implemented business-friendly regulations:

- Passed legislation recognizing blockchain records as legally binding

- Prohibited local governments from imposing taxes or fees on blockchain use

- Created regulatory sandboxes for fintech innovation

States with Specific Cryptocurrency Regulations

Many states have developed targeted regulations for cryptocurrency businesses without being particularly restrictive or permissive:

5. New York

New York implemented the BitLicense regulatory framework in 2015, creating one of the most comprehensive cryptocurrency regulatory systems:

- Requires businesses engaging in "virtual currency business activity" to obtain a BitLicense

- Imposes strict compliance requirements including capital reserves, cybersecurity programs, and anti-money laundering controls

- Has approved only about 30 BitLicenses since inception, reflecting the high barrier to entry

6. California

As the technology capital of the United States, California has taken a measured approach:

- Requires cryptocurrency exchanges to register as money transmitters

- Has proposed but not yet implemented comprehensive cryptocurrency legislation

- Home to many cryptocurrency companies despite regulatory uncertainty

7. Washington

Washington state has specific requirements for cryptocurrency businesses:

- Requires cryptocurrency exchanges to register under the Money Transmitter Act

- Imposes significant bond requirements based on transaction volume

- Mandates third-party security audits for cryptocurrency businesses

8. Florida

Florida has worked to clarify the legal status of cryptocurrencies:

- Amended money transmitter laws to include cryptocurrency businesses

- Established a blockchain task force to recommend regulatory approaches

- Created a more welcoming environment through recent legislative actions

9. Illinois

Illinois has taken steps to integrate blockchain and cryptocurrency into its financial framework:

- Established the Illinois Blockchain Initiative to explore government applications

- Clarified that digital currencies alone don't trigger money transmitter licensing requirements

- Implemented a regulatory sandbox for financial innovation

More Restrictive States

Some states have imposed more stringent requirements on cryptocurrency exchanges or have been slower to provide regulatory clarity:

10. Hawaii

Hawaii has some of the more challenging requirements for cryptocurrency businesses:

- Requires cryptocurrency exchanges to maintain cash reserves equal to all customer cryptocurrency holdings

- This double reserve requirement led some major exchanges like Coinbase to cease operations in the state

- Recently launched a regulatory sandbox to potentially ease restrictions

11. New Mexico

New Mexico's regulatory environment remains uncertain for cryptocurrency businesses:

- Has not updated money transmitter laws to specifically address cryptocurrencies

- Lacks clear guidance on licensing requirements for exchanges

- Few cryptocurrency businesses operate within the state due to regulatory uncertainty

12. Alaska

Alaska's approach to cryptocurrency regulation has been cautious:

- Cryptocurrency exchanges generally must register as money transmitters

- Has issued consumer warnings about cryptocurrency investments

- Limited cryptocurrency business presence due to regulatory uncertainty

How to Determine if Crypto Exchange is Legal in Your State

To determine whether using a cryptocurrency exchange is legal in your state, follow these steps:

1. Check the Exchange's State Availability

Most major cryptocurrency exchanges clearly list the states where they're authorized to operate. Check the exchange's website for a state availability list or terms of service that specify geographic restrictions.

For example:

- Coinbase: Operates in all states except Hawaii (with certain services restricted in New York)

- Kraken: Available in most states but not New York or Washington

- Gemini: Available in all 50 states (one of the few exchanges with this coverage)

- Binance.US: Operates in most states but not New York, Texas, Vermont, or Hawaii

2. Research State-Specific Requirements

Visit your state's financial regulatory authority website to find information specific to cryptocurrency regulation:

- Department of Financial Services (or equivalent)

- State banking department

- Securities regulator

These agencies often provide consumer information about cryptocurrency services and any specific state requirements.

3. Consult Legal Resources

For more complex situations, especially if you're planning to start a cryptocurrency business:

- Consult with an attorney specializing in financial regulation or cryptocurrency law

- Review resources from cryptocurrency advocacy organizations like the Blockchain Association or Coin Center

- Check for recent legislative developments that may have changed your state's regulatory approach

Implications for Cryptocurrency Users

The legal status of cryptocurrency exchanges in your state has several practical implications:

Access to Trading Platforms

- Restricted states: Residents may have fewer exchange options or face additional verification requirements

- Friendly states: Residents typically have access to more exchanges and services

- Workarounds: Some users in restricted states use decentralized exchanges (DEXs) that don't require identity verification, though this may raise compliance concerns

Fee Structures

- Exchanges operating in heavily regulated states often pass compliance costs to customers

- State-specific taxes may apply to cryptocurrency transactions

- Licensing costs in states like New York may result in higher trading fees

Consumer Protections

- States with specific cryptocurrency regulations often provide clearer consumer protections

- Regulatory frameworks typically include requirements for:

- Segregation of customer funds

- Cybersecurity standards

- Disclosure requirements

- Complaint procedures

Recent Regulatory Developments

The cryptocurrency regulatory landscape continues to evolve rapidly. Some notable recent developments include:

State-Level Changes

- Texas passed legislation in 2023 recognizing the legal status of digital assets and creating a framework for banks to custody cryptocurrencies

- Florida enacted legislation in 2023 prohibiting the use of central bank digital currencies as money within the state

- California's governor vetoed a comprehensive cryptocurrency licensing bill in late 2022, sending lawmakers back to the drawing board

- Wyoming continues to expand its crypto-friendly legislation, recently clarifying rules for DAOs (Decentralized Autonomous Organizations)

- New York has begun revising its BitLicense framework to address industry concerns about its restrictive nature

Federal Influences on State Regulation

Federal actions continue to influence state-level approaches:

- SEC enforcement actions against exchanges have prompted some states to reconsider their regulatory approaches

- Banking regulations affecting cryptocurrency companies have created challenges in some states

- Proposed federal legislation could potentially preempt certain state regulations if passed

Special Considerations for Different Activities

The legality of cryptocurrency exchanges can vary depending on the specific activities you're engaging in:

Trading vs. Investing

- Simple buying and holding of cryptocurrencies faces fewer restrictions

- Active trading may trigger additional regulatory requirements

- Different tax implications may apply based on your activity level

Business Activities

If you're operating a cryptocurrency business rather than simply using exchanges as a consumer, additional considerations apply:

- Money transmitter licensing may be required

- State securities regulations may affect token offerings

- Employment and corporate laws vary by state

Mining Activities

Cryptocurrency mining faces its own regulatory challenges:

- Energy usage regulations in states like New York may restrict mining operations

- Tax treatment of mining rewards varies by state

- Zoning restrictions may affect home-based mining operations

Future Outlook for State Cryptocurrency Regulation

The regulatory landscape for cryptocurrency exchanges is likely to continue evolving:

Trends Toward Uniformity

- The Uniform Law Commission has proposed a model Virtual Currency Business Act that could standardize state approaches

- Interstate regulatory cooperation is increasing, potentially reducing inconsistencies

- Federal guidance may eventually create more regulatory uniformity

Ongoing Challenges

- The rapidly evolving nature of cryptocurrency technology often outpaces regulatory frameworks

- Determining jurisdictional boundaries for digital assets remains complex

- Balancing innovation with consumer protection continues to challenge regulators

Practical Steps for Cryptocurrency Users

Regardless of your state's regulatory approach, these best practices can help ensure legal compliance:

- Only use licensed exchanges that are authorized to operate in your state

- Maintain detailed records of all cryptocurrency transactions for tax purposes

- Stay informed about regulatory changes that might affect your cryptocurrency activities

- Consider consulting tax professionals familiar with cryptocurrency regulations in your state

- Use compliance tools that can help track your transaction history and tax obligations

Conclusion: Navigating the Complex Landscape

The answer to "Is crypto exchange legal in my state?" is rarely a simple yes or no. Most states permit cryptocurrency exchanges to operate, but with varying degrees of regulatory requirements that affect which platforms are available to you and how they operate.

As cryptocurrency adoption continues to grow, state regulators are working to develop frameworks that balance innovation with consumer protection. By staying informed about your state's specific regulations and using compliant exchanges, you can participate in the cryptocurrency ecosystem while minimizing legal risks.

Remember that this landscape is constantly evolving, and regulations that apply today may change tomorrow. Regularly checking for updates from both exchanges and state regulatory authorities is the best way to ensure ongoing compliance.

Frequently Asked Questions

Q: Can I use any cryptocurrency exchange if I'm just buying and holding, not trading frequently?

A: No, the exchange must still be legally authorized to operate in your state, regardless of your trading frequency. Using unauthorized exchanges could potentially expose you to legal risks and limit your consumer protections.

Q: What happens if my state introduces new cryptocurrency regulations?

A: Exchanges typically notify users of regulatory changes and may require additional verification information or, in some cases, cease operations in states where they cannot comply with new requirements.

Q: Are decentralized exchanges (DEXs) subject to the same state regulations as centralized exchanges?

A: The regulatory status of DEXs remains unclear in many states. While they may not have the same licensing requirements as centralized exchanges, using them doesn't necessarily exempt you from applicable state laws regarding cryptocurrency transactions.

Q: How do I know if a cryptocurrency exchange is properly licensed in my state?

A: Most state financial regulatory authorities maintain public databases of licensed money transmitters or virtual currency businesses. Additionally, legitimate exchanges typically display their licensing information on their websites.

Q: Could I face penalties for using an unlicensed exchange in my state?

A: While enforcement has typically focused on the exchanges themselves rather than individual users, using unlicensed services could potentially expose you to increased risk of fraud, loss of funds, and legal complications, particularly regarding tax compliance.

By understanding your state's approach to cryptocurrency regulation and following best practices for compliance, you can participate in the growing digital asset ecosystem while minimizing legal and regulatory risks.